Gone are the days when you spend much time preparing payroll and might not even compute the deductions right. Wow!!! Isn’t that something?

With years of experience, we haven’t seen such a comprehensive payroll tool that has all these functions before, where you get to work smart and get accurate results with just a click. It’s unique and affordable.

It can be used using a smart phone, tablet or a computer. Anyone handling payroll can use it.

It has been time tested by many payroll administrators and proven to be very effective. You have no worries because we’ve got your back!!!

The comprehensive payroll tool is here to ease the workload off you and in no time you achieve results

The Comprehensive payroll tool comprises of:

1) Automated comprehensive payroll tool

2) Automated PAYE tool

3) Automated Pay slip tool

4) Automated payroll summary template.

5) An explainer video.

We have you covered! Here, are some reasons why you should get the comprehensive payroll tool now:

1) It accommodates all the payroll allowances.

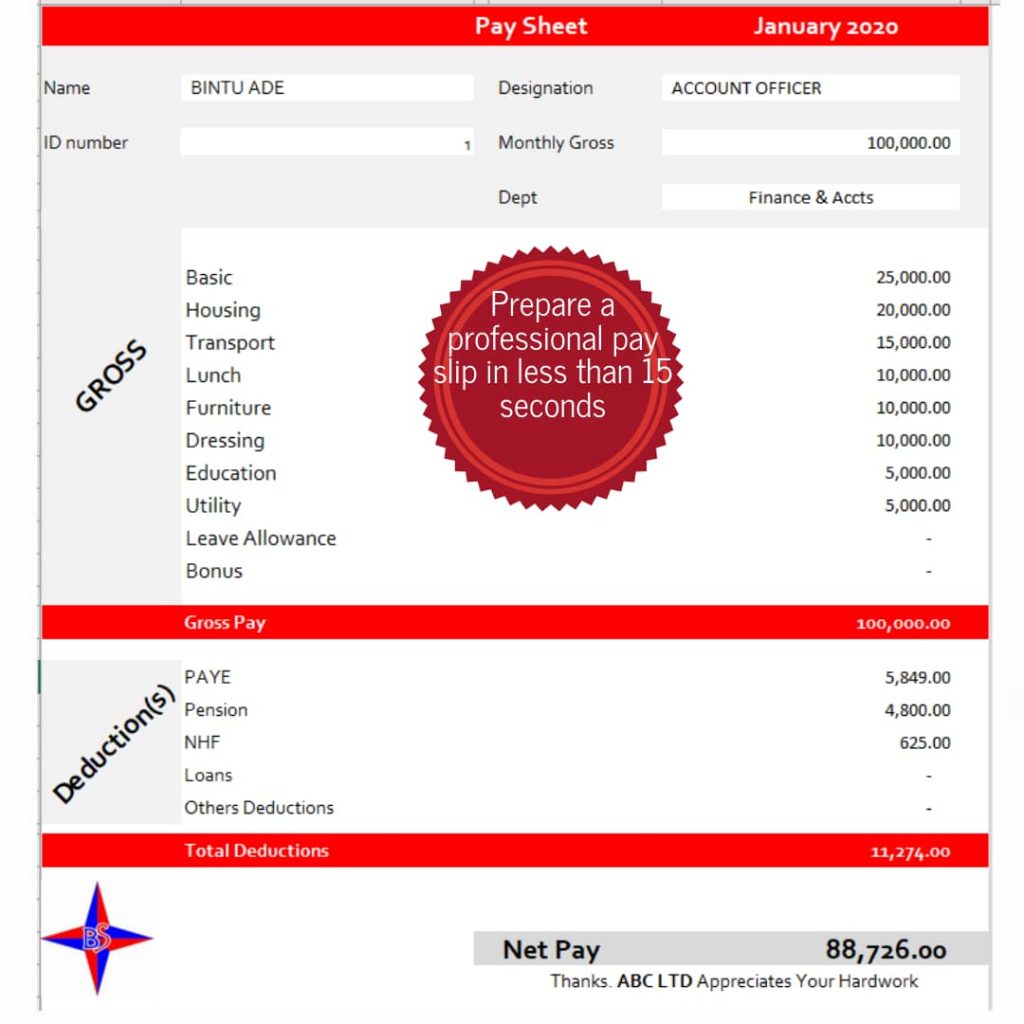

2) It accommodates all statutory deductions and other deductions if any.

3) All vital details on payroll computations are included.

4) Computing PAYE accurately in less than 15 seconds in respective of the number of staff.

5) You get a professional pay slip with staff payroll details accurately with just a click.

6) It captures bank account details as well.

7) You get to prepare your payroll in no time.

8) It is very easy to use.

9) You get to view the annual PAYE for each staff with just one click.

10) It includes a payroll summary sheet stating the gross pay, net deductions, net pay and account details accurately and effortlessly.

11) You get to be confident with the tax man because you know your PAYE accurately.

12) It’s updated with the current tax laws.

13) You get to learn some excel skills.

14) The tools can be used with a smart phone, tablet or computer

15) It can be adjusted to suit your company’s payroll.

WHAT PEOPLE ARE SAYING ABOUT THE TRAINING

#1